Assorted Links (and a chance to win an Amazon gift card)

The Perfect Oilfield (unfortunately, not the STACK/SCOOP/MERGE..):

Once one starts tacking on zeros to the production numbers, Berlin's former tong working brain starts to spin a bit (like chains...). It sounds very impressive and I'm sure the Bedouins of that desert preferred the sovereign didn't own the mineral rights....

Oklahoma Oil and Gas Mineral Owners:

Here are a few links that Berlin read over the weekend that will be of interest:

Duke is sad that he didn't buy more Oklahoma mineral rights and royalties in the MERGE before the Governor James B. Edwards well was drilled by Citizen Energy.

The Perfect Oilfield (unfortunately, not the STACK/SCOOP/MERGE..):

Once one starts tacking on zeros to the production numbers, Berlin's former tong working brain starts to spin a bit (like chains...). It sounds very impressive and I'm sure the Bedouins of that desert prefer the sovereign didn't own the mineral rights. H/T to Tyler Cowen for the link and the introduction to Shellman's blog.

‘Enormous’ Merge Play Resource Rivals Major World Gas Fields (fortunately, the MERGE, unfortunately not the STACK/SCOOP)

The secret has been out for some time, but the Governor James B. Edwards well drilled by Citizen Energy, has led to the development of the MERGE (...who coined this one and what does it stand for?*) and that means money in the door for Oklahoma oil and gas mineral owners in the Tuttle/Minco/Union City area.

Sheriff Takes Food from Prisoners, Locks up Whistle Blower (weird and legal, but shouldn't be)

For some reason, we take liberty for granted. Vote them out.

More to follow,

Berlin

*the wittiest explanation for the MERGE acronym will receive a $10 Amazon gift card. Email Berlin or comment below. Competition ends close of business 27 March 2018.

Tom Ward is back and that is good news for Oklahoma mineral owners

NewsOK business writer Jack "in the" Money, reported a new partnership, BCE-Mach, LLC ("Mach"), that was formed earlier this year between Mach Resources, LLC, and Bayou City Energy. Bayou City Energy will be providing capital to the acquisition and development efforts of Mach Resources, LLC, that is led by Tom Ward.

This announcement should make Oklahoma oil and gas mineral owners smile (and start dreaming about purchasing a new combine...)

Oklahoma Oil and Gas Royalty Owners,

NewsOK business writer Jack "in the" Money, reported a new partnership, BCE-Mach, LLC ("Mach"), that was formed earlier this year between Mach Resources, LLC, and Bayou City Energy. Bayou City Energy will be providing capital to the acquisition and development efforts of Mach Resources, LLC, that is led by Tom Ward.

Mach Lease Bonus = Pleased Oklahoma Mineral Owner

This announcement should make Oklahoma oil and gas mineral owners smile (and dream about purchasing a new combine...). In the recent past, Ward has been associated with Chesapeake Energy, Sandridge Energy, and Tapstone Energy (so much energy that its giving Berlin chest pains). Chesapeake and Sandridge specifically, were known for paying 2x-4x the going lease bonus in the area in order to assemble their prospect.

Mach stated "It is our intent for this platform to be aggressive in consolidating and redeveloping select under capitalized regions of the upstream sector" (in Oklahoma and Kansas). Mach has not recorded any oil and gas leases in Oklahoma to date, but one could read the under capitalized tea leaves steeping in the mid-continent and see Mach stepping back into the watery tar pit f/k/a the Miss Lime.

This would be weird, but not unusual. After all, if you are the only company taking a risk and you fail, you will get fired and will be accused of being a poor steward of your investor's capital and a poor explorationist (Johnny's word, not Berlin's) to boot. But if you are one of many to take a "risk" and you all fail, you may get fired (or may not), but you will be okay enough (because others were just as wrong) that you'll get an "atta boy" or "we understand, the macro-headwinds shifted" or "man, we were just as surprised as you were that the LOE never decreased" and will be able to raise money again.

Either way, it will advantageous for the Oklahoma mineral owner to follow Mach's war path to greatness. If you have any more questions on Mach or you would like to sell your Oklahoma mineral rights and royalties, please contact Berlin.

More to follow,

Berlin

Splitting the Baby and the Pooling Bonus

The Oklahoma Corporation Commission has been regulating on the fly as to rule changes on multi-unit horizontal wells. One of the recent changes is that applicants now must offer a formation election if the applicant desires to force pool more than one common source of supply. Berlin thinks that this effects the unleased Oklahoma mineral owner more than the commissioners had originally intended...

Oklahoma Oil and Gas Mineral Owners:

The Oklahoma Corporation Commission has been regulating on the fly as to rule changes on multi-unit horizontal wells. One of the recent changes is that applicants now must offer a formation election if the applicant desires to force pool more than one common source of supply. Berlin thinks that this effects the unleased Oklahoma mineral owner more than the commissioners had originally intended.

Your call Sol...splitting the pooling bonus for the Oklahoma oil and gas mineral owners.

Old World for the Mineral Owner:

The Commission effectively put a stop to applicants pooling from the surface to granite, instead allowing the the applicant to only pool her target formation and the formation directly uphole and directly downhole. For example, if the applicant proposed a Woodford well, she would have been allowed to pool the Mississippian, Woodford, and Hunton. For simplicity's sake, if my man Bruce was an unleased Oklahoma mineral owner and did not want to participate in the Woodford well with his 10 net mineral acres, he would elect out of the initial well and thus have given up his ability to participate in any Mississippian, Woodford, or Hunton wells while the forced pooling order was in effect. If the only option in lieu of participation was $1,200 per net mineral acre and a 3/16 royalty, Bruce would receive $12,000 from the applicant.

New World for the Mineral Owner:

The situation has now changed with formation elections. The applicant now has to testify to the perspective value of a well in each formation she expects to pool in order to proportionally allocate the bonus amount. If she testifies that the Mississippian, Woodford, and Hunton are equally perspective, they would receive 1/3 of the allocated bonus each. Now if Bruce elects not to participate in the drilling of the initial Woodford well, he will only receive $4,000 from the applicant ($1,200/nma * (1/3) * 10). If the applicant does not propose a Mississippian or Hunton well during the primary term of the forced pooling order, Bruce will never have an opportunity to make an election and thus will never be compensated for his Mississippian and Hunton formations being pooled for a year.

Now many of you will shout "Berlin, you're a goon, Bruce's Mississippian and Hunton will be open after the primary term of the order." And that is true. Bruce will most likely be open in a year where he could lease or even propose his own well. But Berlin would argue that after a horizontal operator has drilled a Woodford well in the unit, the chances of another operator paying Bruce a premium for his Mississippian and Hunton rights would be unlikely unless better wells are eventually made in the the Mississippian or Hunton.

As there are pros and cons to formation elections for the Oklahoma mineral owner, there are also pros and cons for the applicant/operator. Pro: Her pooling bonus will be lower in the short term, in the case above 1/3 of what it would have been under the old regime. This will be even more advantageous for the operator who is pooling (as opposed to leasing) a greater amount of acreage. Con: Many companies are now valued on their net acres in multiple formations. So now if the operator pools more acreage and initially only drills Woodford wells, her Mississippian acreage count will not see a benefit from the pooling proceedings. This should be somewhat intuitive, she didn't pay for it, she doesn't own it (unless she can convince a bigger fish with someone else's money to pay her for the Mississippian acreage if it is during the primary term of the pooling order).

Conclusion:

Berlin predicts that these rules will change at some point in the future and that an Oklahoma mineral owner will again be permitted to elect out of all formations held by the pooling order in order to receive 100% of the pooling bonus from the outset (TVM, even if they don't call it that...).

If you have any more questions on split bonus payments under Oklahoma Corporation Commission forced pooling orders or you would like to sell your Oklahoma mineral rights and royalties, please contact Berlin.

More to follow,

Berlin

Extending an Oil and Gas Lease

It can happen to the best of us, it was three years ago and nobody was drilling deep gas in Custer. You signed an oil and gas lease with an option to extend the primary term. Now, things are different, the "macro-headwinds" have shifted. There are folks with deep pockets paying 3x what you will be paid for your option. Even though $500/acre for a 160 acre lease on the home place would make most smile, you have a yellow equipment problem...

Oklahoma Oil and Gas Mineral Owners,

It can happen to the best of us, it was three years ago and nobody was drilling deep gas in Custer. You signed an oil and gas lease with an option to extend the primary term. Now, things are different, the "macro-headwinds" have shifted. There are folks with deep pockets paying 3x what you will be paid for your option. Even though $500/acre for a 160 acre lease on the home place would make most smile, you have a yellow equipment problem and were hoping that the original lessee will overlook the option and you will be able to sign a new lease at $1500/acre and buy that excavator you have always dreamed of. So what can you do?

Some oklahoma oil and gas mineral owners trade their right to drill a well for a royalty and yellow equipment

Some Oklahoma oil and gas mineral owners will attempt to claim that they never received the option bonus. While most lessees who desire to exercise their option will call the lessor to confirm their address before mailing a check, the call is not required. To perfect the option, a lessee is required to send the bonus payment to the lessor's address via certified mail and file an affidavit of lease extension with the county clerk. A lessor is playing with fire if they do not accept the certified mail in order to claim that their bonus was never paid.

What should another company do that would like to buy a lease from a lessor who has a option to extend in their old oil and gas lease that they claim was not exercised? Berlin argues they should do the following to protect themselves:

- Ask the lessor if they have been contacted by the lessee or its assigns or moved since they signed the lease.

- Check the records to see if the lessee filed affidavits of extension in the section or the surrounding sections. It would be odd that the lessee would extend some leases, but not others.

- Request the lessor warrant title to the lease.

- Require the lessor file an affidavit of non-payment and file the affidavit in front of the new oil and gas lease.

People do weird things when money is involved (and isn't is usually?). As was said in the gun club, "U Signed the M*****f****** Contract." There is no reason to complain (or commit fraud) if the option that you agreed to is exercised. And the company who desires to buy a fresh lease should protect themselves from bad behavior.

Berlin wrote this post because a loyal reader asked to learn more about the situation. If you have any more Oklahoma oil and gas leasing or mineral rights questions, or would like to sell your Oklahoma royalties or mineral rights, please comment below or drop Berlin a line.

More to follow,

Berlin

Mark Papa's Got a Brand New Bag, and it's Weird

Mark Papa of Centennial Resource Development, Inc. ("Centennial") has made some bold statements recently regarding the future of oil and natural gas production from shale reservoirs. The thrust of his claim is that energy companies will not be able to produce as much oil and gas as they have forecasted. Berlin will not fault Papa for his statement, which could very well prove to be correct, but she believes that his arguments are faulty. Since Berlin has not interviewed Papa, all that she can analyze are his public statements. Berlin's comments are bolded and italicized after Papa's quotes:

Oklahoma Oil and Gas Interest Owners,

Mark Papa of Centennial Resource Development, Inc. ("Centennial") has made some bold statements recently regarding the future of oil and natural gas production from shale reservoirs. The thrust of his claim is that energy companies will not be able to produce as much oil and gas as they have forecasted. Berlin will not fault Papa for his statement, which could very well prove to be correct, but she believes that his arguments are faulty. Since Berlin has not interviewed Papa, all that she can analyze are his public statements. Berlin's comments are bolded and italicized after Papa's quotes:

- “The oil market is in a state of misdirection now” - Unfounded statements like these give Berlin the willies. Oil is a commodity traded across the globe in high volumes. In which direction should the oil market be heading besides it's current direction? Papa doesn't say whether the price is too high or too low, but Berlin assumes Papa means that company stock prices are too high...? Hard to know.

- "Mr. Papa told executives and investors that most of the best drilling locations in North Dakota and South Texas have already been tapped." - This should also give one pause. Maybe he could re-frame it as the best drilling locations that we know about in North Dakota and South Texas have been tapped. But, Berlin would presume that Papa would concede that there are unconventional reservoirs in North Dakota and South Texas that haven't been discovered. If he wouldn't concede that, then he should make a bolder claim such as "exploration geology in North Dakota and South Texas is fruitless as everything worth finding has been discovered." Papa isn't going to say that of course. In addition, even if the best locations in North Dakota and South Texas have been tapped, they aren't the only places to find oil and gas in economic quantities. He excluded every other basin to include the Anadarko and the Permian (where Papa's company is focused).

- “Apparently, you can just use your imagination to dream what might happen with big data in five or 10 years.” - This skeptical take on the future of technology in the oil and gas sector is just mere paragraphs before the article mentions how, while at EOG, Papa utilized new technology to drill for oil in shale reservoirs instead of gas. It would be odd if Centennial wasn't spending money on R & D or continued using vendors and service companies that have failed to innovate. (note, Berlin isn't screaming "put it on a blockchain," just that it isn't logical to discount how technology will further change the industry. Something tells Berlin, that Papa hasn't spent all night prying casing joints around with 2x4's before they are sent up the cat-walk and through the v-door....there is some room for automation...)

The Godfather of Oklahoma mineral rights. Not the same Papa.

Maybe the weirdest part is that Papa is still at the helm of Centennial, a pure-play Permian concern currently valued around $5 billion. Papa hasn't said how he has positioned Centennial to cope with the "misdirection." Berlin argues that it is a bit self-serving of Papa to claim the market is too optimistic, but keep his company long. And if it isn't self-serving, then should his shareholders be upset that he believes the sector (which would include Centennial) is overvalued and that he hasn't returned more cash to shareholders? It would take some brass ones to take the other side of the trade. It is difficult for any publicly traded oil company to decrease production from one time period to the next and while staying in the good graces of "the market." Then again, shareholders continue to buy high and sell low. Berlin has argued before that managers and shareholders are often misaligned and that seems to be the case again with Centennial and Papa.

If Papa or anyone else feels like Berlin has erred in analyzing Papa's statements, please comment below.

More to follow,

Berlin

Spudding Before Forced Pooling

Bruce was a bit pissed when he called up Berlin today. Apparently, his fence line weaning efforts cost him about 6 hours of sleep after he found the fence knocked down and the calves back with their mommas. After he calmed down a bit, he asked why so many operators are spudding their wells before a forced pooling order has issued and what his options are as an unleased Oklahoma oil and gas mineral owner named as a respondent in the pooling proceedings...

Oklahoma Oil and Gas Interest Owners:

Bruce was a bit pissed when he called up Berlin today. Apparently, his fence line weaning efforts cost him about 6 hours of sleep after he found the fence knocked down and the calves back with their mommas. After he calmed down a bit, he asked why so many operators are spudding their wells before a forced pooling order has issued and what his options are as an unleased Oklahoma oil and gas mineral owner named as a respondent in the pooling proceedings.

There are a few reasons why an Oklahoma operator might spud a well before an Oklahoma Corporation Commission ("OCC") forced pooling order is issued.

- As Berlin discussed yesterday, the OCC is short staffed and the review and issuance of orders is taking a substantial amount of time and in some cases up to 5 months after the pooling was recommended at the hearing. In order to feed the rig monster, operators must keep drilling their wells. After all, a pooling order is not needed to obtain a permit to drill.

- If a forced pooled unit is not formed and there is no Joint Operating Agreement or any other voluntary pooling of leasehold interest between the working interest owners in the unit, there is no mechanism to govern the development of the unit. One of the consequences of this action is that there are no mechanisms to handle costs. And if a fellow working interest owner can't pay his costs, the operator will not provide well info. In short, operators will spud a well without a forced pooling order so they will not have to share well information in the short term with their competitors.

- Forced poolings can be a time suck. Dealing with asinine requests on pre-pooling letter agreements, setting protest dates, and finally the protests themselves are often an exercise in busy work. If an operator has a high working interest in the spacing unit, she might just spud the well and file a pooling application in time to have the order issue before the division order title opinion needs to be rendered.

The rig monster never sleeps, but enjoys purchasing Oklahoma oil and gas mineral rights before a horizontal well is drilled. It increases his NRI and keeps his LPs happy.

The operator incurs a risk when he drills before a pooling order has issued. Hopefully, he has used the time to evaluate the well and if he's made a good well, to lease the offsetting acreage. However, if he had issues drilling or made a marginal well, he is in danger of owning 100% of the working interest as the other working interest parties will have scouted the well and will elect out of the unit when the pooling order issues at a later date. So what are Bruce's options as an Oklahoma oil and gas mineral owner? Once the order issues, he should read the order as it will contain the usual options, however, he should be more strategic as he will have more information available to him.

- If the operator has made a good well, Bruce's interest will now be substantially more valuable. Bruce could participate in the well if he has completed his diligence on the property and scouted the location. However, Berlin's recommendation is that only professional mineral owners should participate in wells. Still, his mineral interest should command a premium with non-op companies who have other people's money to spend. Bruce should be able to negotiate an oil and gas lease with better terms than those found in the forced pooling order.

- If the operated drilled a dud, it is unlikely that any non-op will seek Bruce out for his interest unless the non-op just wants to participate with a small amount of acreage in order to obtain well information. In this case, Bruce should just elect the option in lieu of participation under the pooling order that works best for he and his family's situation (ie does he need cash now to buy replacement heifers or maybe more royalty later if an operator decides to density the section).

Berlin hopes she answered Bruce's question. If you have any more questions about forced pooling, or you would like an offer to sell your Oklahoma oil and gas mineral rights. Please drop Berlin a line or comment below.

More to follow,

Berlin

Free Rider Problem: Fee Increases at the Oklahoma Corporation Commission

The Oklahoma Corporation Commission (the "OCC") plays a large, but often misunderstood role in the Oklahoma oil and gas industry ecosystem. The OCC is the regulator of almost all (less Osage County) oil and gas production in the state. Jack "Show me the" Money (a name destined for fame on the business desk) at NewsOK wrote a column regarding the proposed fee changes at the OCC...

Oklahoma Oil and Gas Interest Owners:

The Oklahoma Corporation Commission (the "OCC") plays a large, but often misunderstood role in the Oklahoma oil and gas industry ecosystem. The OCC is the regulator of almost all (less Osage County) oil and gas production in the state. Jack "Show me the" Money (a name destined for fame on the business desk) at NewsOK wrote a column regarding the proposed fee changes at the OCC.

Malcolm Smith: Never heard him discuss Oklahoma royalties or the free rider problem, but man could he ride.

The processing time for final orders has increased over the past year as activity has increased in the STACK and SCOOP. This slows down drilling activity in the state. If the OCC did not want to increase fees or negotiate for a larger budget to hire more folks, it would be different than every other government agency since the beginning of time. But, before an increase in fees is implemented, the state should conduct a study on what the different applications actually cost to process. For instance:

"Increasing the permit fee to drill a well. The permitting fee now is $175, regardless of the type of well. The new fees would range from $750 for a vertical well to as much as $3,500 for a multiunit, horizontal well. The commission estimates the cost to process applications currently ranges from $580 to $2,900, depending on the type of well involved."

Instead of "estimates," the OCC should have a dollar figure that represents the cost. And, if in fact a application does cost $2,900 to process, why should the fee be $3,500? Government entities should not be profiting from their operations. If anything, their revenues (i.e. fees and taxes) should cover the marginal cost of administration while the agency should always be attempting to lower their marginal costs.

Applicants and operators bear a majority of the burden of the fees at the OCC. While it is true that the applicant is the reason of the marginal labor expense at the OCC, the "benefits" of regulation accrue to all parties who own an Oklahoma oil and gas interest. One of the purposes of the OCC is to prevent economic waste and to protect correlative rights. While the applicant for an increased density application will have to pay the fee for the time of the clerks, administrative law judges, and commissioners to review, the Oklahoma mineral owners and the working owners in the offset wells are the parties who benefit from the OCC's technical and administrative review of the application. This is an example of a free rider problem.

The solution to this issue would be some type of split to fund the OCC between both taxpayer dollars and fees from the applicants. Berlin can hears the shouts now "hey Berlin, this is how the OCC is already funded!" And Berlin knows that. She would just appreciate some data and logical reasoning before the public spends even more private dollars.

More to follow,

Berlin

PS: Please contact Berlin if you would like to sell any Oklahoma mineral rights. We pay top dollar to buy Oklahoma oil and gas royalties and will close quickly.

Do You Boat Acreage or Push Paper?

Back when Berlin started schlepping leases, her boss claimed there were really only two kinds of landmen; there were landmen who boat acreage and landmen who chased rig lines and pushed paper around their desks. Then he asked, what kind of landman did Berlin want to be?...

Oklahoma Oil and Gas Interest Owners,

Are you going to fill up the boat with acres of leasehold and Oklahoma mineral rights or worthless paper and wasted efforts?

Back when Berlin started schlepping leases, her boss claimed there were really only two kinds of landmen; there were landmen who boat acreage and landmen who chased rig lines and pushed paper around their desks. Then he asked, what kind of landman did Berlin want to be? While at Amoco one had to do both, but there was certainly a bias towards the landman who could boat acreage. After all, what is a landman's purpose if she can't secure mineral rights for the technical team to exploit?

The early successes of Chesapeake Energy further emphasized the importance of acquiring leases. McClendon's philosophy was that if Chesapeake owned it all, the company wouldn't have to bend to the will of the Conoco's of the world to facilitate a trade (like a 20 year earn-out on some Western Anadarko Basin properties....thanks gents for the stellar proposal).

The ease and speed of modern communication has altered how most landmen spend their time. It is now possible for a landman to spend his entire day emailing about an issue that could be solved in a phone call or worse yet, one that doesn't even need to be solved at all. Requests from the division order departments about curative, land managers about title tracking, and nitpicking another company landman over the smallest details of a pre-pooling letter agreement can be all consuming. The relative cheapness of the communication medium hides the immense opportunity costs of engaging in this type of behavior.

Cal Newport often writes about how the quality of work and the productivity of the average knowledge worker is in decline. He claims we are now worse at creating valuable things. And this is true. Economic oil and gas prospects are valuable. As land staffs become bloated and perform less of what Newport has coined "Deep Work," it takes more man hours to put together an oil and gas prospect. Putting together a prospect requires boating acreage. And boating acreage requires deliberate, focused efforts from running title to the disciplined negotiation that is necessary to acquire oil and gas leases in a competitive environment.

There is a lot of paper to push around these days, but does it need to be pushed?

More to follow,

Berlin

I Thought You Were a Professional?

Berlin was having coffee at the sale barn this week where she ran across an ol' boy named Keith. Keith asked Berlin what she did when she wasn't raising stockers and she mentioned she's a landman. Keith looked a bit perplexed when he said "a landman? I thought you were a professional, like an accountant or doctor or some sh*t....

Oklahoma Minerals Owners,

Berlin was having coffee at the sale barn this week where she ran across an ol' boy named Keith. Keith asked Berlin what she did when she wasn't raising stockers and she mentioned she's a landman. Keith looked a bit perplexed when he said "a landman? I thought you were a professional, like an accountant or doctor or some sh*t."

Sorry to disappoint Keith, both you and daddy wished Berlin was a doctor or some shi*t too. But even landmen can continue to learn. Below are some items that Berlin thought might be of interest to the readers of The Oil Scout.

Everything from these pipe fences to producing oil and gas from Oklahoma mineral property is going to become more expensive thanks to the new tariffs.

Saturday Assorted Links

Learning How to Learn: A new course from Coursera created by UC San Diego

Never Split the Difference: Negotiations book (recommended, but you can't use what you learn when negotiating the sale of your Oklahoma oil and gas royalty interests to Berlin)

The Tariff Folly: This tax increase on imported aluminum and steel will punish American workers, invite retaliation that will harm U.S. exports, and make everything that is made out of aluminum and steel more expensive (so...,almost everything). Berlin predicts this will negatively affect the Oklahoma oil and gas industry more than the proposed increase in the gross production tax that the OIPA enjoys complaining about.

More to follow,

Berlin

How Can One Prove That They Exist?

Berlin received a call today from Sage, a good friend who also happens to be a company landman, Sage reported that an Oklahoma mineral owner just called to chew on his leg as the mineral owner had never heard of Sage's company (despite the fact they've drilled about 70 wells in the past 2 years). He wanted Sage to prove that his company was legitimate and their lease offer was valid...

Oklahoma Oil and Gas Royalty Owners:

Berlin received a call today from Sage, a good friend who also happens to be a company landman, Sage reported that an Oklahoma mineral owner (Red) just called to chew on his leg as the mineral owner had never heard of Sage's company (despite the fact they've drilled about 70 wells in the past 2 years). He wanted Sage to prove that his company was legitimate and their lease offer was valid.

Sage could have handled Red and his Oklahoma mineral rights in a more professional manner. Never ask about another man's jeans.

Sage was a bit perplexed as there he was speaking with another human who received a letter that Sage signed and mailed and was questioning Sage's existence. Sage asked if there was a Straussian reading of the question, but the mineral owner told Sage that it was none of his f***ing business, but that he was proud to wear Wranglers.

But with crooks on the loose, it is a valid concern. How can a Oklahoma oil and gas mineral owner verify that the company that she has been approached by is legitimate? Here are a few suggestions:

-Verify the company is registered with the Oklahoma Secretary of State.

-Verify the company is bonded with the Oklahoma Corporation Commission (if they claim to operate).

-Inquire with your neighbors if they have been contacted by the same outfit.

-Examine the index at the county clerk's office or search for recently recorded instruments on Oklahoma County Records.

-Contact Berlin for more options.

If Sage had suggested any one of the above, he probably could have boated a lease from that call. Instead, Sage lost his cool at the owner's insistence that Sage was a fly-by-night shyster so he slammed the phone on big Red from Anadarko.

More to follow,

Berlin

Is $10 Actually the Bonus Per Acre?

Oklahoma Mineral Rights Owners,

Berlin received another call from Bruce today. He was angry and slightly confused. Bruce was sure that some fly-by-night lease flipper was fixin' to cheat him out of his lease bonus. The Duncan, Oklahoma based outfit had offered him $1,100 per net mineral acre for a 3 + 2, oil and gas lease at a 3/16 royalty for some of his granddaddy's minerals in Beckham County, Oklahoma, which Bruce accepted...

Oklahoma Mineral Rights Owners,

Berlin received another call from Bruce today. He was angry and slightly confused. Bruce was sure that some fly-by-night lease flipper was fixin' to cheat him out of his lease bonus. The Duncan, Oklahoma based outfit had offered him $1,100 per net mineral acre for a 3 + 2, oil and gas lease at a 3/16 royalty for some of his granddaddy's minerals in Beckham County, Oklahoma, which Bruce accepted.

No Oklahoma oil and gas mineral owner is getting jammed on ole girl's watch.

However, upon review of the lease, Bruce read the following statement "Witnesseth that the said Lessor, for and in consideration of Ten and more Dollars, cash in hand paid, the receipt of which is hereby acknowledged...do grant, demise, lease..." Bruce asked the buyer to replace the ten dollars with the actual bonus due and the buyer balked. Bruce asked Berlin if this was proper or if he was getting jammed.

Berlin told Bruce that this is the industry standard and that lessees of Oklahoma oil and gas leases do not place the actual bonus paid of record by writing it into the oil and gas lease. As long as Bruce was satisfied with the terms of payment, the "and more" of the consideration and granting clause that he was presented is legitimate.

Berlin has written about the terms of the basics of the oil and gas lease before, but if you have any more questions about an oil and gas lease or you are interested in leasing or selling your mineral rights please comment below or drop us a line.

More to follow,

Berlin

Smooth Move: Oklahoma Independent Petroleum Association

All,

If Berlin was a betting woman, she would venture to guess that an organization with the words "Independent Petroleum Association" in the title and that represents itself as the unified voice and advocacy group for the Oklahoma oil and natural gas industry might support an independent producer in court proceedings against a municipality. In most cases, the bet would pay out, but not when the Independent Petroleum Association in question is the Oklahoma Independent Petroleum Association (the "OIPA")....

All,

If Berlin was a betting woman, she would venture to guess that an organization with the words "Independent Petroleum Association" in the title and that represents itself as the unified voice and advocacy group for the Oklahoma oil and natural gas industry might support an independent producer in court proceedings against a municipality. In most cases, the bet would pay out, but not when the Independent Petroleum Association in question is the Oklahoma Independent Petroleum Association (the "OIPA").

In a truly bizarre action, the OIPA, filed a motion with the Canadian County District Court to file brief of amicus curiae to oppose the actions of Citizen Energy II, LLC, a Tulsa based, independent oil and gas operator. There are various Latin terms contained in their motion, but the gist of their argument is that the municipality, Mustang, Oklahoma, was within their right to only conditionally approve the permit to drill. Not only is this weird because the OIPA is supposed to advocate for independent oil and gas producers, but it sponsored legislation to hamstring municipalities' restrictions on drilling operations in 2015 (52. §O.S. 137.1).

Were we supposed to hit send on this fancy letter to the judge?

In a quote from the OIPA's 2018 annual meeting invitation:

After years of oppressive regulation and months of low prices, we’re making the independent oil and natural gas industry great again. Come reflect on our success, plan for the future, expand your knowledge and take it easy at the legendary OIPA Annual Meeting.

Their words, not Berlin's. Who doesn't love greatness? Berlin would like to ask the OIPA how they define success (and legendary), but they would probably just say that it comes before work in the dictionary. Now, Berlin isn't arguing the validity of Mustang's case, she just finds it odd that the advocacy group is anti-advocating. Would it have been a better idea for the OIPA to keep its expensive opinions to itself? Its one thing to whisper to your attorney over a bloody at Cheever's and say "hey, why don't we hang Citizen out to dry?" It's quite another to be openly hostile and support Mustang.

The staff of the OIPA don't appear to be oil and gas folks, but their board appears to be comprised of industry professionals. Berlin is positive that one of the 80 board members own or are employed by companies who will attempt to drill a well inside a municipal boundary in the next year. Did they vote on this action? Weird.

The cat that came in from the cold and now must be nice to the other cats in the office.

It really isn't any surprise the OIPA fumbled this extremely easy to hold (easy_to_hold = nerf) football. Most Southern Oklahoma producers defected last year to form the Oklahoma Energy Producers Alliance after they were disgusted with the OIPA's policies towards extricating Oklahomans from the financial tar bit that is the State's budget. The larger independents left before that to lead the Oklahoma Oil and Gas Association. All groups advocate for crony capitalism and preferential treatment, but only the OIPA advocates for preferential treatment of groups that oppose the companies that compose its membership.

As 1stSgt Benny once yelled at a young Corporal for agreeing with a Lieutenant, "whose side are ****ing you on" it might be time to ask the crew over at the OIPA the same question, but in an "inside cat" tone of voice.

More to follow,

Berlin

Reversionary Mineral Interests: The Term Mineral Deed

Oklahoma Oil and Gas Mineral Owners,

Today, Berlin was approached by a fellow oil and gas royalty owner (let's call him Bruce) who needed some assistance as he just received an unexpected division order in his mailbox (nice problem to have by the way). After some researching we found that his father conveyed his Carter County, Oklahoma minerals via a term mineral deed fifty years ago. A term mineral deed is a type of reversionary interest. According to Black's the definition of reversion is:

In real property law, a reversion is the residue of an estate left by operation of law in the grantor or his heirs, or in the heirs of a testator, commencing in possession on the determination of a particular estate granted or devised.

And a reversionary interest is:

The interest which a person has in the reversion of lands or other property. A right to the future enjoyment of property, at present in the possession or occupation of another.

Bruce's father with the tie and cigarette. He sold his Oklahoma mineral rights on a term mineral deed to finance his "Summer of Love" exploits. The man knew how to smoke.

In landman terms, this just means that the property in question will automatically go back to the original grantor or the successors of that grantor's interest to the property when a certain condition is met. The conditions could include such mechanisms as a back in, an overriding royalty interest to working interest option and others which Berlin will cover at a later date. This reversionary interest in question today was simply a term that was written into a mineral deed.

Terms are very common in the oil and gas business. The most common instrument with a term is the oil and gas lease. However, conveyances of a fee mineral interest can also contain a term and that is what Bruce owned. Long story short, Bruce's father conveyed his minerals to a grantee in 1967 for a term of 50 years. Occasionally, the term of a term mineral deed may be perpetuated by production, but that was not the case here. Simply put, the minerals rights owned by Bruce's father would revert to his heirs (if they were conveyed the reversionary rights) 50 years to the day from the original effective date of the conveyance.

Often, reversionary interests with longer terms are lost in the inter-generational shuffle of heirs. In this case, Bruce is fortunate that the attorney who originally rendered the title opinion for the operator made a note of this term instrument so the operator was able to track it through the years. Bruce is also lucky that the operator of the lease had drilled the original well in the 1970s and continues to operate the lease to the present day. This is uncommon.

If you have any further questions about reversionary or term instruments and your Oklahoma mineral rights, or you would like to discuss selling your mineral rights or oil and gas royalties (with or without a term) please contact Berlin or comment below.

More to follow,

Berlin

See What Happens Larry? Oil and Gas Mineral Rights in the News.

Oklahoma Oil and Gas Mineral Owners,

The Federal Bureau of Investigation (“FBI”), announced that LAWRENCE H. WOLF, a/k/a “Larry,” was arrested yesterday for defrauding banks and financial institutions around the country. Manhattan U.S. Attorney Geoffrey S. Berman said: “As alleged, Lawrence Wolf swindled and attempted to swindle banks around the country out of millions of dollars while masquerading as an oil and gas tycoon. Now, thanks to the dedicated work of our partners at the FBI, Wolf’s alleged scheme has finally run dry.”

A tale as old as time. A slick huckster in cowboy boots will convince a number of yield-starved investors that he has a deal for them. We saw it in "Stealing from the Rich" and "Funny Money" and we will continue to see it as long as there are mineral rights to exploit and people walking the earth (so another 73 years...?).

Do you see what happens when you commit fraud by claiming ownership in others' mineral rights?

Berlin's favorite part of the story though is that four banks lent Larry money and only the "global investment firm" actually ran title to the oil and gas properties in Wyoming that Larry was claiming ownership in.

While Berlin has claimed in the past that some title is difficult, it is less difficult that explaining to your boss why you lent Larry millions without checking the records.

H/T to Matt Levine for the news and Special Agent Justin Rowland for putting the pieces together.

Bankers of the world, please advise Berlin if you are planning to lend on oil and gas mineral rights, royalties, or leases without running title and we can prevent you from being identified as a "Victim Firm."

More to follow,

Berlin

Saturday Night Special

Somebody owns the oil and gas mineral rights beneath Lynyrd Skynyrds' feet.

Buyers of Oklahoma Mineral Rights, a Small Business Enterprise

Oklahoma Royalty Owners,

Tyler Cowen recently posted about the five smallest industries by firm size.

They are:

Fishing, hunting, trapping: 3.1 workers on average

Building construction: 5.5 workers on average

Real estate: 5.9 workers on average

Funds, trusts, and other financial vehicles: 6 workers on average

Repair and maintenance: 6.1 workers on average

While Berlin doesn't have access to the base data, your author would hazard a guess that most buyers of Oklahoma oil and gas mineral rights are also smaller firms. Most companies who buy Oklahoma royalties are one-two person operations with a couple contractors on call to assist with title due diligence. If you are interested in selling your mineral rights and royalties, please call Berlin at 918.984.1645 to receive an offer today.

More to follow,

Berlin

Share Buybacks: Weird News from Matt Levine

Oklahoma Oil and Gas Royalty Owners:

The always outstanding Matt Levine of Bloomberg, wrote great commentary on a recent Wall Street Journal piece about share buybacks in the oil and gas industry.

Matt quotes:

Laredo’s shares are trading more than 20% below what the company sold stock for in three offerings during the downturn.

snake_oil = "Public Equities" print (snake_oil)

Public Equities

Noble Energy Inc. and Gulfport Energy Corp. are likely to buy at even bigger discounts to what they sold shares for in recent years. Noble said last week it would use proceeds from the sale of its Gulf of Mexico fields to repurchase $750 million of its stock, which is trading about 45% below the $47.50 its shares fetched in a $1.15 billion offering three years ago. Gulfport said it plans to buy back $100 million of the stock it sold at prices ranging from $21.50 to $47.75 in four offerings between April 2015 and December 2016. The Oklahoma City company’s shares ended Friday at $8.75.

and writes:

Don't get used to this! It is traditional to make fun of companies for buying high and selling low when they trade their own stock, but it is surely better than the alternative. After all, there is someone on the other side of those trades, and it's the shareholders. If companies could regularly raise money by selling stock when business was bad, and then buy that stock back more cheaply when business recovered, then what would be the point of investing in stocks?

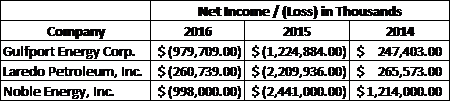

Berlin believes that most public oil/gas equities are a hustle to begin with. SEC reporting requirements and metrics mislead the public about the health of the company. Net income for the companies mentioned above are captured in the chart:

Who likes losing massive amounts of money?

Why do folks buy shares of a company (who Berlin presumes actually want a claim on future profits and cash flows of that company) that sells its assets for less than it takes to replace them? Why continually throw money at a money losing enterprise where management incentives are so clearly misaligned from yours? A mystery to Berlin. Management lacks the skin in the game to promote reasonable governance. Berlin forecasts these managers blaming "capital markets" and "a shift in the macro-headwinds" before a mea culpa.

More to follow,

Berlin

The OIPA who Cried Wolf

All,

This wolf is not impressed with the OIPA's fear mongering

The Oklahoma Independent Petroleum Association claims to represent more than 2,500 individuals and companies from Oklahoma's oil and natural gas industry. It has been in the news quite often lately, usually labeled as the group who is blocking pay raises for teachers. It's Berlin's opinion, that this is the case. While the state government has failed its citizens, there is no doubt the actions of lobbyists have ultimately harmed the taxpayers. There is nothing that smells of crony "capitalism" more than a tax exempt organization lobbying for an already tax advantaged industry to pay even fewer taxes. Berlin despises the tax man as much as anyone else, however Berlin detests special treatment and rent seeking behavior even more. Oil and gas producers will continue to drill and develop oil and gas mineral rights as there are still hydrocarbons to be economically produced despite an increase in the production tax.

The OIPA has continued a negative campaign against anyone who opposes its agenda. It promotes such movements as Oilpatch Proud, as if the patch is more deserving of tax payer money than any other sector. In 2015, the OIPA spent nearly half of its revenues ($1.4m) on salaries. In addition, it spent $835k on "other expenses" which would include the actual lobbying and "educating" of our elected officials. Frightening, but not surprising that the calls from the OIPA for "more money to fight the wind lobby" are really pleas for higher compensation for themselves at the expense of nearly everyone else.

Berlin stands with the King.

More to follow,

Berlin

Crooks on the loose in Caddo County, Oklahoma

Oklahoma Mineral Owners,

Pretty Boy Floyd looking awfully content with himself after cold drafting an Oklahoma oil and gas mineral owner.

As we have discussed previously, it is important that you are aware of the financial condition of your potential lessee before agreeing to an oil and gas lease. While exchanging a check for an oil and gas lease is the best way to trade, many fly-by-night lease turning operations still prefer bank sight drafts. The reason for this is simple, it allows them to control mineral rights (your mineral rights) for a specified period of time, without paying for them. Be aware that receiving a draft usually implies that the lessee has not run title on your interest and likely won't close on the oil and gas lease you negotiated unless he can find a buyer to flip it to during the term of the draft.

Berlin has received a number of calls recently regarding an Oklahoma outfit leasing in Caddo County who has been sending 90 business day sight drafts (that's four months) and filing the leases in the meantime. Some of the lessors have been without payment for over six months. This is borderline criminal behavior and gives all landmen in the area a bad name. If approached by a company like this, it is recommended that you call other active parties in the area for better payment terms. If would you like the respectable parties leasing in Northern Caddo County, Oklahoma, please drop Berlin a line or an email to inquire.

More to follow,

Berlin

Have you given up on this project?

Just a couple of war dogs, Amos Tversky and Daniel Kahneman toast to their partnership in the 1970s. Courtesy of Barbara Tversky

Oklahoma Mineral Owners,

Have you ever tried to contact a company landman or lease buyer and never hear back from them? Of course, your answer is "yes." I recommend you email them the following..."have you given up on this <project/lease/trade?" This phrase triggers an immediate reaction in the recipient. Research has shown that loss aversion drives action more than the desire for gain. Or, call Berlin at 918.984.1645 if you would like to sell your oil and gas minerals. We will always answer and listen to your initial offer. What other negotiation tactics have you found to be the most useful?

More to follow,

Berlin

Ready to Sell?

Request your No Cost, No Obligation Offer to Trade or Sell Your Oklahoma Mineral Rights and Oil and Gas Royalties by Clicking Here or Calling Berlin Royalties at 918.984.1645