I Thought You Were a Professional?

Berlin was having coffee at the sale barn this week where she ran across an ol' boy named Keith. Keith asked Berlin what she did when she wasn't raising stockers and she mentioned she's a landman. Keith looked a bit perplexed when he said "a landman? I thought you were a professional, like an accountant or doctor or some sh*t....

Oklahoma Minerals Owners,

Berlin was having coffee at the sale barn this week where she ran across an ol' boy named Keith. Keith asked Berlin what she did when she wasn't raising stockers and she mentioned she's a landman. Keith looked a bit perplexed when he said "a landman? I thought you were a professional, like an accountant or doctor or some sh*t."

Sorry to disappoint Keith, both you and daddy wished Berlin was a doctor or some shi*t too. But even landmen can continue to learn. Below are some items that Berlin thought might be of interest to the readers of The Oil Scout.

Everything from these pipe fences to producing oil and gas from Oklahoma mineral property is going to become more expensive thanks to the new tariffs.

Saturday Assorted Links

Learning How to Learn: A new course from Coursera created by UC San Diego

Never Split the Difference: Negotiations book (recommended, but you can't use what you learn when negotiating the sale of your Oklahoma oil and gas royalty interests to Berlin)

The Tariff Folly: This tax increase on imported aluminum and steel will punish American workers, invite retaliation that will harm U.S. exports, and make everything that is made out of aluminum and steel more expensive (so...,almost everything). Berlin predicts this will negatively affect the Oklahoma oil and gas industry more than the proposed increase in the gross production tax that the OIPA enjoys complaining about.

More to follow,

Berlin

How Can One Prove That They Exist?

Berlin received a call today from Sage, a good friend who also happens to be a company landman, Sage reported that an Oklahoma mineral owner just called to chew on his leg as the mineral owner had never heard of Sage's company (despite the fact they've drilled about 70 wells in the past 2 years). He wanted Sage to prove that his company was legitimate and their lease offer was valid...

Oklahoma Oil and Gas Royalty Owners:

Berlin received a call today from Sage, a good friend who also happens to be a company landman, Sage reported that an Oklahoma mineral owner (Red) just called to chew on his leg as the mineral owner had never heard of Sage's company (despite the fact they've drilled about 70 wells in the past 2 years). He wanted Sage to prove that his company was legitimate and their lease offer was valid.

Sage could have handled Red and his Oklahoma mineral rights in a more professional manner. Never ask about another man's jeans.

Sage was a bit perplexed as there he was speaking with another human who received a letter that Sage signed and mailed and was questioning Sage's existence. Sage asked if there was a Straussian reading of the question, but the mineral owner told Sage that it was none of his f***ing business, but that he was proud to wear Wranglers.

But with crooks on the loose, it is a valid concern. How can a Oklahoma oil and gas mineral owner verify that the company that she has been approached by is legitimate? Here are a few suggestions:

-Verify the company is registered with the Oklahoma Secretary of State.

-Verify the company is bonded with the Oklahoma Corporation Commission (if they claim to operate).

-Inquire with your neighbors if they have been contacted by the same outfit.

-Examine the index at the county clerk's office or search for recently recorded instruments on Oklahoma County Records.

-Contact Berlin for more options.

If Sage had suggested any one of the above, he probably could have boated a lease from that call. Instead, Sage lost his cool at the owner's insistence that Sage was a fly-by-night shyster so he slammed the phone on big Red from Anadarko.

More to follow,

Berlin

Is $10 Actually the Bonus Per Acre?

Oklahoma Mineral Rights Owners,

Berlin received another call from Bruce today. He was angry and slightly confused. Bruce was sure that some fly-by-night lease flipper was fixin' to cheat him out of his lease bonus. The Duncan, Oklahoma based outfit had offered him $1,100 per net mineral acre for a 3 + 2, oil and gas lease at a 3/16 royalty for some of his granddaddy's minerals in Beckham County, Oklahoma, which Bruce accepted...

Oklahoma Mineral Rights Owners,

Berlin received another call from Bruce today. He was angry and slightly confused. Bruce was sure that some fly-by-night lease flipper was fixin' to cheat him out of his lease bonus. The Duncan, Oklahoma based outfit had offered him $1,100 per net mineral acre for a 3 + 2, oil and gas lease at a 3/16 royalty for some of his granddaddy's minerals in Beckham County, Oklahoma, which Bruce accepted.

No Oklahoma oil and gas mineral owner is getting jammed on ole girl's watch.

However, upon review of the lease, Bruce read the following statement "Witnesseth that the said Lessor, for and in consideration of Ten and more Dollars, cash in hand paid, the receipt of which is hereby acknowledged...do grant, demise, lease..." Bruce asked the buyer to replace the ten dollars with the actual bonus due and the buyer balked. Bruce asked Berlin if this was proper or if he was getting jammed.

Berlin told Bruce that this is the industry standard and that lessees of Oklahoma oil and gas leases do not place the actual bonus paid of record by writing it into the oil and gas lease. As long as Bruce was satisfied with the terms of payment, the "and more" of the consideration and granting clause that he was presented is legitimate.

Berlin has written about the terms of the basics of the oil and gas lease before, but if you have any more questions about an oil and gas lease or you are interested in leasing or selling your mineral rights please comment below or drop us a line.

More to follow,

Berlin

Smooth Move: Oklahoma Independent Petroleum Association

All,

If Berlin was a betting woman, she would venture to guess that an organization with the words "Independent Petroleum Association" in the title and that represents itself as the unified voice and advocacy group for the Oklahoma oil and natural gas industry might support an independent producer in court proceedings against a municipality. In most cases, the bet would pay out, but not when the Independent Petroleum Association in question is the Oklahoma Independent Petroleum Association (the "OIPA")....

All,

If Berlin was a betting woman, she would venture to guess that an organization with the words "Independent Petroleum Association" in the title and that represents itself as the unified voice and advocacy group for the Oklahoma oil and natural gas industry might support an independent producer in court proceedings against a municipality. In most cases, the bet would pay out, but not when the Independent Petroleum Association in question is the Oklahoma Independent Petroleum Association (the "OIPA").

In a truly bizarre action, the OIPA, filed a motion with the Canadian County District Court to file brief of amicus curiae to oppose the actions of Citizen Energy II, LLC, a Tulsa based, independent oil and gas operator. There are various Latin terms contained in their motion, but the gist of their argument is that the municipality, Mustang, Oklahoma, was within their right to only conditionally approve the permit to drill. Not only is this weird because the OIPA is supposed to advocate for independent oil and gas producers, but it sponsored legislation to hamstring municipalities' restrictions on drilling operations in 2015 (52. §O.S. 137.1).

Were we supposed to hit send on this fancy letter to the judge?

In a quote from the OIPA's 2018 annual meeting invitation:

After years of oppressive regulation and months of low prices, we’re making the independent oil and natural gas industry great again. Come reflect on our success, plan for the future, expand your knowledge and take it easy at the legendary OIPA Annual Meeting.

Their words, not Berlin's. Who doesn't love greatness? Berlin would like to ask the OIPA how they define success (and legendary), but they would probably just say that it comes before work in the dictionary. Now, Berlin isn't arguing the validity of Mustang's case, she just finds it odd that the advocacy group is anti-advocating. Would it have been a better idea for the OIPA to keep its expensive opinions to itself? Its one thing to whisper to your attorney over a bloody at Cheever's and say "hey, why don't we hang Citizen out to dry?" It's quite another to be openly hostile and support Mustang.

The staff of the OIPA don't appear to be oil and gas folks, but their board appears to be comprised of industry professionals. Berlin is positive that one of the 80 board members own or are employed by companies who will attempt to drill a well inside a municipal boundary in the next year. Did they vote on this action? Weird.

The cat that came in from the cold and now must be nice to the other cats in the office.

It really isn't any surprise the OIPA fumbled this extremely easy to hold (easy_to_hold = nerf) football. Most Southern Oklahoma producers defected last year to form the Oklahoma Energy Producers Alliance after they were disgusted with the OIPA's policies towards extricating Oklahomans from the financial tar bit that is the State's budget. The larger independents left before that to lead the Oklahoma Oil and Gas Association. All groups advocate for crony capitalism and preferential treatment, but only the OIPA advocates for preferential treatment of groups that oppose the companies that compose its membership.

As 1stSgt Benny once yelled at a young Corporal for agreeing with a Lieutenant, "whose side are ****ing you on" it might be time to ask the crew over at the OIPA the same question, but in an "inside cat" tone of voice.

More to follow,

Berlin

Reversionary Mineral Interests: The Term Mineral Deed

Oklahoma Oil and Gas Mineral Owners,

Today, Berlin was approached by a fellow oil and gas royalty owner (let's call him Bruce) who needed some assistance as he just received an unexpected division order in his mailbox (nice problem to have by the way). After some researching we found that his father conveyed his Carter County, Oklahoma minerals via a term mineral deed fifty years ago. A term mineral deed is a type of reversionary interest. According to Black's the definition of reversion is:

In real property law, a reversion is the residue of an estate left by operation of law in the grantor or his heirs, or in the heirs of a testator, commencing in possession on the determination of a particular estate granted or devised.

And a reversionary interest is:

The interest which a person has in the reversion of lands or other property. A right to the future enjoyment of property, at present in the possession or occupation of another.

Bruce's father with the tie and cigarette. He sold his Oklahoma mineral rights on a term mineral deed to finance his "Summer of Love" exploits. The man knew how to smoke.

In landman terms, this just means that the property in question will automatically go back to the original grantor or the successors of that grantor's interest to the property when a certain condition is met. The conditions could include such mechanisms as a back in, an overriding royalty interest to working interest option and others which Berlin will cover at a later date. This reversionary interest in question today was simply a term that was written into a mineral deed.

Terms are very common in the oil and gas business. The most common instrument with a term is the oil and gas lease. However, conveyances of a fee mineral interest can also contain a term and that is what Bruce owned. Long story short, Bruce's father conveyed his minerals to a grantee in 1967 for a term of 50 years. Occasionally, the term of a term mineral deed may be perpetuated by production, but that was not the case here. Simply put, the minerals rights owned by Bruce's father would revert to his heirs (if they were conveyed the reversionary rights) 50 years to the day from the original effective date of the conveyance.

Often, reversionary interests with longer terms are lost in the inter-generational shuffle of heirs. In this case, Bruce is fortunate that the attorney who originally rendered the title opinion for the operator made a note of this term instrument so the operator was able to track it through the years. Bruce is also lucky that the operator of the lease had drilled the original well in the 1970s and continues to operate the lease to the present day. This is uncommon.

If you have any further questions about reversionary or term instruments and your Oklahoma mineral rights, or you would like to discuss selling your mineral rights or oil and gas royalties (with or without a term) please contact Berlin or comment below.

More to follow,

Berlin

See What Happens Larry? Oil and Gas Mineral Rights in the News.

Oklahoma Oil and Gas Mineral Owners,

The Federal Bureau of Investigation (“FBI”), announced that LAWRENCE H. WOLF, a/k/a “Larry,” was arrested yesterday for defrauding banks and financial institutions around the country. Manhattan U.S. Attorney Geoffrey S. Berman said: “As alleged, Lawrence Wolf swindled and attempted to swindle banks around the country out of millions of dollars while masquerading as an oil and gas tycoon. Now, thanks to the dedicated work of our partners at the FBI, Wolf’s alleged scheme has finally run dry.”

A tale as old as time. A slick huckster in cowboy boots will convince a number of yield-starved investors that he has a deal for them. We saw it in "Stealing from the Rich" and "Funny Money" and we will continue to see it as long as there are mineral rights to exploit and people walking the earth (so another 73 years...?).

Do you see what happens when you commit fraud by claiming ownership in others' mineral rights?

Berlin's favorite part of the story though is that four banks lent Larry money and only the "global investment firm" actually ran title to the oil and gas properties in Wyoming that Larry was claiming ownership in.

While Berlin has claimed in the past that some title is difficult, it is less difficult that explaining to your boss why you lent Larry millions without checking the records.

H/T to Matt Levine for the news and Special Agent Justin Rowland for putting the pieces together.

Bankers of the world, please advise Berlin if you are planning to lend on oil and gas mineral rights, royalties, or leases without running title and we can prevent you from being identified as a "Victim Firm."

More to follow,

Berlin

Saturday Night Special

Somebody owns the oil and gas mineral rights beneath Lynyrd Skynyrds' feet.

Buyers of Oklahoma Mineral Rights, a Small Business Enterprise

Oklahoma Royalty Owners,

Tyler Cowen recently posted about the five smallest industries by firm size.

They are:

Fishing, hunting, trapping: 3.1 workers on average

Building construction: 5.5 workers on average

Real estate: 5.9 workers on average

Funds, trusts, and other financial vehicles: 6 workers on average

Repair and maintenance: 6.1 workers on average

While Berlin doesn't have access to the base data, your author would hazard a guess that most buyers of Oklahoma oil and gas mineral rights are also smaller firms. Most companies who buy Oklahoma royalties are one-two person operations with a couple contractors on call to assist with title due diligence. If you are interested in selling your mineral rights and royalties, please call Berlin at 918.984.1645 to receive an offer today.

More to follow,

Berlin

Share Buybacks: Weird News from Matt Levine

Oklahoma Oil and Gas Royalty Owners:

The always outstanding Matt Levine of Bloomberg, wrote great commentary on a recent Wall Street Journal piece about share buybacks in the oil and gas industry.

Matt quotes:

Laredo’s shares are trading more than 20% below what the company sold stock for in three offerings during the downturn.

snake_oil = "Public Equities" print (snake_oil)

Public Equities

Noble Energy Inc. and Gulfport Energy Corp. are likely to buy at even bigger discounts to what they sold shares for in recent years. Noble said last week it would use proceeds from the sale of its Gulf of Mexico fields to repurchase $750 million of its stock, which is trading about 45% below the $47.50 its shares fetched in a $1.15 billion offering three years ago. Gulfport said it plans to buy back $100 million of the stock it sold at prices ranging from $21.50 to $47.75 in four offerings between April 2015 and December 2016. The Oklahoma City company’s shares ended Friday at $8.75.

and writes:

Don't get used to this! It is traditional to make fun of companies for buying high and selling low when they trade their own stock, but it is surely better than the alternative. After all, there is someone on the other side of those trades, and it's the shareholders. If companies could regularly raise money by selling stock when business was bad, and then buy that stock back more cheaply when business recovered, then what would be the point of investing in stocks?

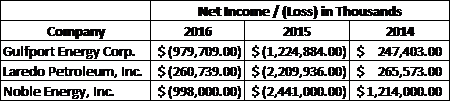

Berlin believes that most public oil/gas equities are a hustle to begin with. SEC reporting requirements and metrics mislead the public about the health of the company. Net income for the companies mentioned above are captured in the chart:

Who likes losing massive amounts of money?

Why do folks buy shares of a company (who Berlin presumes actually want a claim on future profits and cash flows of that company) that sells its assets for less than it takes to replace them? Why continually throw money at a money losing enterprise where management incentives are so clearly misaligned from yours? A mystery to Berlin. Management lacks the skin in the game to promote reasonable governance. Berlin forecasts these managers blaming "capital markets" and "a shift in the macro-headwinds" before a mea culpa.

More to follow,

Berlin

The OIPA who Cried Wolf

All,

This wolf is not impressed with the OIPA's fear mongering

The Oklahoma Independent Petroleum Association claims to represent more than 2,500 individuals and companies from Oklahoma's oil and natural gas industry. It has been in the news quite often lately, usually labeled as the group who is blocking pay raises for teachers. It's Berlin's opinion, that this is the case. While the state government has failed its citizens, there is no doubt the actions of lobbyists have ultimately harmed the taxpayers. There is nothing that smells of crony "capitalism" more than a tax exempt organization lobbying for an already tax advantaged industry to pay even fewer taxes. Berlin despises the tax man as much as anyone else, however Berlin detests special treatment and rent seeking behavior even more. Oil and gas producers will continue to drill and develop oil and gas mineral rights as there are still hydrocarbons to be economically produced despite an increase in the production tax.

The OIPA has continued a negative campaign against anyone who opposes its agenda. It promotes such movements as Oilpatch Proud, as if the patch is more deserving of tax payer money than any other sector. In 2015, the OIPA spent nearly half of its revenues ($1.4m) on salaries. In addition, it spent $835k on "other expenses" which would include the actual lobbying and "educating" of our elected officials. Frightening, but not surprising that the calls from the OIPA for "more money to fight the wind lobby" are really pleas for higher compensation for themselves at the expense of nearly everyone else.

Berlin stands with the King.

More to follow,

Berlin

Crooks on the loose in Caddo County, Oklahoma

Oklahoma Mineral Owners,

Pretty Boy Floyd looking awfully content with himself after cold drafting an Oklahoma oil and gas mineral owner.

As we have discussed previously, it is important that you are aware of the financial condition of your potential lessee before agreeing to an oil and gas lease. While exchanging a check for an oil and gas lease is the best way to trade, many fly-by-night lease turning operations still prefer bank sight drafts. The reason for this is simple, it allows them to control mineral rights (your mineral rights) for a specified period of time, without paying for them. Be aware that receiving a draft usually implies that the lessee has not run title on your interest and likely won't close on the oil and gas lease you negotiated unless he can find a buyer to flip it to during the term of the draft.

Berlin has received a number of calls recently regarding an Oklahoma outfit leasing in Caddo County who has been sending 90 business day sight drafts (that's four months) and filing the leases in the meantime. Some of the lessors have been without payment for over six months. This is borderline criminal behavior and gives all landmen in the area a bad name. If approached by a company like this, it is recommended that you call other active parties in the area for better payment terms. If would you like the respectable parties leasing in Northern Caddo County, Oklahoma, please drop Berlin a line or an email to inquire.

More to follow,

Berlin

Have you given up on this project?

Just a couple of war dogs, Amos Tversky and Daniel Kahneman toast to their partnership in the 1970s. Courtesy of Barbara Tversky

Oklahoma Mineral Owners,

Have you ever tried to contact a company landman or lease buyer and never hear back from them? Of course, your answer is "yes." I recommend you email them the following..."have you given up on this <project/lease/trade?" This phrase triggers an immediate reaction in the recipient. Research has shown that loss aversion drives action more than the desire for gain. Or, call Berlin at 918.984.1645 if you would like to sell your oil and gas minerals. We will always answer and listen to your initial offer. What other negotiation tactics have you found to be the most useful?

More to follow,

Berlin

$700,000 for a 1% ORRI

Oklahoma Mineral Owners,

Has the time arrived when it can be said that mineral and royalty buying outfits have truly lost their minds? Received a forwarded letter from a friend this past week where a well known, out of state mineral rights buyer offered him $700,000 for his 1% overriding royalty interest in a big Continental Resources, Inc. well is western Blaine County, Oklahoma. Truly a staggering sum of money. What type of reserves would have to be produced for that trade to reach payout?

Purchase Price (PP): $700,000

Gas Price (GP): $2.60/mcf

PP/GP: ~269,230

(PP/GP)/0.01 = ~26,923,077 mcf or ~27 billion cubic feet of gas (I'm a landman, not a gasman mathman, so I think this is correct, if it isn't, please comment)

Yes, this unit would have to produce 27bcf before deductions and taxes to reach pay out. Deducts with Continental are no laughing matter where they will easily skin you for 1/3 of your gross sales. Then kick another 25% to the taxman. Hard to see where this trade will pay out for this out of state, private equity backed buyer. She's making her cut, but the LPs are getting hosed and then don't even know it yet.

Despite the well results, I think we can conclude that the smart money would sell and and let the yield starved buyers talk about this one and the rest of their deployed capital at the Denver County Club.

More to follow,

Berlin

Dewey County SITREP

(This post originally appeared on www.oklahomaminerals.com on July 11, 2017)

All,

Oklahoma Oil and Gas Mineral Owners, as companies are consolidating their positions in the SCOOP and STACK, Dewey County appears to be one of the next counties on the frontier for explorationists. While some consider it a part of the NW STACK Extension, we should consider ourselves fortunate that it hasn’t been branded with another absurd acronym.

In the past 12 months, there have been 6,601 leases filed at the courthouse in the county seat of Taloga by numerous operators and brokers. Even with few well completions in the county, lease bonuses have continued to accelerate through the first half of 2017. While there are portions of Dewey that were heavily promoted during the deep gas days, in general, both the mineral and leasehold title chains are not as difficult to decipher as they are in the SCOOP or the Arkoma Basin. This is plus for landmen who can acquire leases quickly without squandering time and their land budgets on complicated title work.

There are two distinct plays being pursued in Dewey County. The first is a Pennsylvanian system play. Leading the charge is Mewbourne Oil Company with 11 pooling orders, and eight completions in a mix of both Cottage Grove and Cleveland wells. Other notable operators pursing similar targets are Arnold Oil Properties and JMA Energy Company. These companies have been active in Dewey County for a few years with little competition from private equity backed or publicly traded companies.

The reason for the increased activity in Dewey County however, is the hope that well results from the STACK Mississippian and Woodford wells will translate into similar results further to the West. In the past 12 months, there have been 11 applicants granted Pooling Orders from the Oklahoma Corporation Commission for the Mississippian and/or Woodford common sources of supply in Dewey County. For this discussion, Pooling Orders will be our metric to measure presence and activity level in Dewey County. The companies, the number of Pooling Orders issued and leases and/or assignments taken are detailed below.

It is clear from the data above that the four leading companies into the county are Tapstone, Continental, Council Oak (who purchased the Wolf Bend leases), and Carrera. The numbers deserve more analysis. Both Council Oak and Carrera have the same rich father (Encap Investments). As in the case with most private equity backed companies, once the sponsor deems that the company will achieve certain metrics with a sale, they will begin a process. It will be interesting to see if Carrera and Council Oak will be marketed together or separately.

Tapstone announced in April that the company will go public with the goal to raise $100m in the initial public offering. While Tapstone claims to own approximately 400,000 acres across the Anadarko Basin, most of its recent activity has occurred in Dewey and Woodward Counties. With an IPO on the horizon, one should expect prolonged activity in the area by Tapstone.

As always, Continental is the wild card. With a seemingly endless budget for leasing and exploration, your correspondent believes that 12 Pooling Orders and 563 leases is just the beginning and that Continental, despite its reputation for higher than average well costs, will be the development leader going forward in Dewey County.

More to follow,

Berlin

Coal County SITREP

Oklahoma Oil and Gas Mineral Owners,

The Arkoma Basin has been playing second fiddle to the STACK for some time now, but the sleeping gas giant appears to be rubbing the sleep from its eyes. Leasing and transaction activity is accelerating in Coal County, Oklahoma. In the last twelve months, there have been 1739 oil and gas leases filed of record in Coalgate by numerous operators and brokers

There have been five companies in the past year who have been granted Pooling Orders in Coal County by the Oklahoma Corporation Commission. For this discussion, Pooling Orders will be our metric to measure presence and activity level in Coal County. The Companies and the number of Pooling Orders issued are detailed on the chart below.

| Company |

Number of Pooling Orders |

|---|---|

| Bravo Arkoma, LLC |

9 |

| Canyon Creek Energy Operating, LLC |

7 |

| Pablo Energy, LLC |

6 |

| Newfield Exploration Mid-Continent, Inc. |

3 |

| BP America Production Company |

1 |

The chart deserves a bit more analysis. With its enormous legacy position from the Amoco days, it is not surprising to see some activity from BP. With a market capitalization of $100b, I’m not sure what moves the needle for BP, but I don’t think it is a Hunton/Sylvan test in Coal County. Bravo and Canyon Creek are the two operators to watch. With Pooling Orders covering from the Hartshorne to the Arbuckle, it will be interesting to observe how their positions develop. It appears from the 1002As that have been filed, Bravo is exploiting the Woodford while Canyon Creek is exploiting the Cromwell and Woodford.

Title is just nasty in the Arkoma and Coal County is no exception. Minerals tracts can be cut 100 ways. The only consolation is that most of the historical production has been spaced on 640 acres which does make the held-by-production title work a bit easier in contrast to the Golden Trend. Remember to contact Berlin, if you are wanting to buy mineral rights or sell mineral rights in Oklahoma, specifically Coal County. Standby for further reporting on developments in the Arkoma.

More to follow,

Berlin

Oklahoma Energy Jobs Act of 2017

(This post originally appeared on www.oklahomaminerals.com on April 19, 2017)

All,

House Bill 1613 and Senate Bill 284, together known as the The Oklahoma Energy Jobs Act of 2017 (“OEJA”), were introduced on January 18, 2017 and January 19, 2017, respectively. The intent of the proposed legislation is to modify the 2011 Shale Reservoir Development Act (“SRDA”).

The SRDA provided two new tools for the development of shale reservoirs. Tool one allows the drilling of a horizontal well in shale reservoirs across existing unit boundaries (i.e. the drilling of a multi-unit well) and provisions to distribute costs, production, and proceeds to each of the affected units. Tool two, which sofar has been seldom utilized, allows for the unitization of a shale reservoir.

The end state of the OEJA is to allow operators to drill multi-unit horizontal wells in all formations. Currently, under the SRDA, operators are only allowed to drill multi-unit horizontal wells in shale formations. The mechanism to achieve the proposed end state is to redefine the definition of “targeted reservoir” from a shale to include any formation potentially suited for development through a horizontal well.

Horizontal operators are clearly in support of this legislation. By drilling multi-unit wells, the operator and its partners can realize huge savings. Your columnist would be speaking out of school if he opined on the specifics of the drilling and completions disciplines, but for example, if an AFE for a one mile lateral ia $5m, then is would cost an operator $15m to develop three sections. If an AFE for a 1.5 mile lateral is 6.5m, then it would only cost $13m to develop the three sections. These savings are partly realized through the efficiencies of pad drilling, decreased rig and other rental costs and production facility centralization.

Vertical operators are opposed to this legislation. The differences of opinion between horizontal and vertical operators have caused a rift in the Oklahoma Independent Petroleum Association, the largest lobbying organization for the oil and gas industry in the state. Vertical operators are concerned that increased horizontal activity in the formations in which their wells currently produce will have a large impact on their operations. Drilling and completions undoubtedly may affect the production and future production of producing wellbores and reservoirs.

With current activity in the state so dramatically tilted in the direction of horizontal drilling, your columnist believes the OEJA will be enacted over the objections of the vertical operators, but the Oklahoma Corporation Commission is likely attempt to protect the rights of the vertical operator through administrative rulings as a type of consolation prize. A student of economics would argue that this is clearly an example of what Schumpeter coined, “creative destruction,” and an anticipated consequence of technological innovation and progress.

More to follow,

Berlin

The Farmout: What You Need To Know

(This post originally appeared on www.oklahomaminerals.com on December 3,2016)

All,

In many areas now designated as the SCOOP and STACK, there are oil and gas leases that have been held-by-production for decades. It is often a boon for the current operator of the vertical wellbore and his working interest partners to have an asset so highly desired by horizontal operators. Often, the horizontal operators will not pay the asking price the vertical operators demand for their production and outright sale of their oil and gas leases, and thus, the only items on the trade blocks are the deeper, usually undeveloped formations that the horizontal operator desire to develop and exploit. There are many ways to strike a deal in the patch, but today’s article will focus on the farmout agreement.

A farmout agreement is a common agreement in oil and gas transactions where the current working interest owner (“Farmor”) agrees to convey all or a portion of his working interest in the oil and gas lease to a second party (“Farmee”) who desires to drill a well on the oil and gas lease. The primary difference between a farmout and an assignment is that the Farmee must drill and/or complete one or more wells (the “Earning Well”) in order finalize the transfer of the working interest in the oil and gas lease.

The Farmout: What You Need To Know

A potential Farmor might entertain a farmout for a number of reasons. He might not have the expertise, knowledge, or technical equipment in order to exploit the geology. He might be unsure of the geology or unwilling to take the risk. He also might not have the capital to deploy to drill the new well.

The Farmee might entertain a farmout for a number of reasons. Likely, as in the case in the SCOOP and STACK, is that a farmout might one of the only methods for the horizontal operator to obtain rights in his desired formation that is currently held by production by existing oil and gas leases. He will also have the requisite capital and technical expertise to incur the risks of drilling the Earning Well.

There are a number of key terms that must be defined in the farmout agreement. The following should be specified:

- The commitment – Does the Farmee have to drill one well to earn the agreement or multiple wells? Or does the Farmee have to expend a certain dollar amount instead aspecified number of wells? Does the Farmee have to drill-to-earn or produce-to-earn the Earning Well?

- The term – How long does the Farmee have to commence operations?

- The oil and gas leases to be earned by the Farmee

- The target formation and well location of the Earning Well

- The Farmor’s retained interest – What formations is he reserving from the conveyance? Is he reserving an overriding royalty interest? Are there any back in after payout provisions? How are these provisions calculated?

- The Form of Assignment of Oil and Gas Leases to be recorded after the farmout has been earned by the Farmee.

In conclusion, farmouts are one of the ways for horizontal operators to obtain working interest in held-by-production properties and farmouts differ from assignments in that there must be an action performed by the Farmee for him to earn the working interest in the oil and gas leases. There are a multitude of ways to structure a farmout agreement, however, these are the basics provisions that need to be hashed out by the Farmor and the Farmee. If there are any other topics you would like to discuss, please mention your ideas in the comment section.

More to follow,

Berlin

Four Key Pieces of Correspondence for the Oklahoma Mineral Owner

(This post originally appeared on www.oklahomaminerals.com on November 8,2016)

All,

Landmen are no busier than most professionals during the work day, but it is often stated that company landmen never return the calls of mineral owners. While this might be true of the bottom 10% of the profession, most landmen know that by placing a single call to a mineral owner, he could spend 30 minutes explaining knowledge that could easily be obtained throughsimple internet research. An informed mineral owner, who asks a poignant question, is much more likely to receive the answer he needs than the owner who calls to ask the difference between a spacing application and a well proposal.

Admittedly, if one owns a single tract of minerals or maybe just inherited the minerals, then the inaugural process of leasing and receiving the regulatory paperwork while the company is assembling the drilling and spacing unit would surely baffle most.

In general, there are four key pieces of correspondence that an Oklahoma mineral owner will receive from the landman. These occasions are detailed in brief below.

The Offer to Lease

Often, the first time an Oklahoma mineral owner will be contacted by a landman is when the landman’s company is assembling a prospect. The mineral owner will be contacted by phone and/or mail with an offer to lease their mineral interest. Most landmen will offer at least two options which will differ in the amount of cash bonus per net mineral acre and the royalty.

The Well Proposal

After the landman has made a bona fide effort to reach an agreement with all owners who own the right to drill a well in the proposed unit, he will send a well proposal to the parties with whom he has not yet reached an agreement. The well proposal will offer final terms in lieu of participation in the well and details of the well to be drilled such as location, proposed depth, target formation, estimated depth and cost of the well in the event the party would like to participate. It is important to note that in Oklahoma, an election to participate in the well is not binding until the party elects under the pooling order.

Oklahoma Corporation Commission Applications

Initially one of the most confusing aspects of being an Oklahoma mineral owner is the receipt of Oklahoma Corporation Commission (“OCC”) applications and orders. Some owners ask why they are being sued and others ask to be removed from the mailing list. Owners receive the applications and orders because Operators and applicants are required by law to provide notice of their activities to the owners who their activity affects. These applications are orders are mailed from an attorney who represents the applicant in OCC matters. The three most common applications that an owner will receive are the spacing application, location exception application, and pooling application. These applications will be discussed in detail at a later date, but the pooling application will be the application that will have the largest effect on the mineral owner’s rights and pocketbook. The OCC publishes a handbook for mineral owners that can be found http://www.occeweb.com/og/PubAsst/WebRoyaltyOwnersHandbook3-2015.pdf

The Division Order

If an operator successfully drills and completes a well, the next correspondence the mineral owner will receive from the company is the division order. A division order is an instrument which sets forth the proportional ownership in the produced hydrocarbons. The proportional ownership is communicated to the owner on the instrument in a decimal form. After the division order is signed and curative title issues are completed, the mineral owner should receive their first check within six months from the date of first production from the well.

In conclusion, the four key pieces of correspondence that an Oklahoma mineral owner will receive from the landman and the company, are the offer to lease, the well proposal, Oklahoma Corporation Commission applications and orders and finally, the division order. All four of these topics will be expanded upon in future articles. If there are any other topics you would like to discuss, please mention your ideas in the comment section.

More to follow,

Berlin

Chesapeake Fall from the Barnett

All,

John McFarland at Oil and Gas Lawyer Blog has a thought provoking post about Chesapeake's trade to Saddle Barnett Resources, LLC in the Barnett Shale. It is incredible that Chesapeake is essentially trading what used to be it's most prized asset while paying $334 million to extricate itself from an onerous gas purchasing agreement.

It should not be lost on the shareholders that the gas purchasing agreements were an accounting trick that Chesapeake negotiated with itself before the midstream company spun off as Access Energy. To quote from McFarland's piece,

"Recall that Chesapeake originally built out its own gathering system for its Barnett wells, which was held in an affiliate called Chesapeake Midstream. It spun those assets off into a separate, public entity called Access Midstream, but not before entering into a gathering agreement with its affiliate that provided very favorable terms to Chesapeake Midstream, including payment of a minimum volume commitment, which required Chesapeake to pay for a minimum volume of gas, even if it could not provide the gas. This gathering agreement greatly enhanced the market value of the spinoff, Access Midstream, which was later acquired by Williams. Since gas prices have remained low, Chesapeake has not been able to deliver its minimum volume commitment, increasing its gathering and transportation costs to the point where they exceeded the price it could get for its gas."

If that's not Funny Money, I don't know what is. Another case of management's incentives not being aligned with investors and most importantly a board consisting of know-nothing yes men who found their rubber stamp at the 11th hour.

More to follow,

Berlin

The Golden Trend and the Junkyard Dog

All,

While the SCOOP and STACK receive most of the national press from bankers who love generalizations, trends, and acronyms, the venerable Golden Trend of Garvin County and McClain County has once again regained prominence.

The Golden Trend is roughly contained by a box constructed with Township 3N-4W in the lower left and Township 5N-3W in the upper right. The field was drilled beginning in late 1940s and has been productive in zones at many levels in the hydrocarbon column since that time. In 2015, production from the active wells totaled 2,853,809 barrels of oil and 41,493 mmcf of gas.

There have been three large trades in the field in the past two months. Rimrock Resource Operating (Tulsa) purchased the Merit Energy assets. Casillas Petroleum (Tulsa) purchased the Chesapeake Golden Trend package and is the undisclosed buyer of Continental Resources' "non-core" SCOOP assets which includes the Golden Trend leases.

With Merit and Casillas' entry into the play and the recent exploration activity by Citizen Energy II (Tulsa) and Eagle Exploration Production (Tulsa), the Golden Trend is poised to again become an active area of the Anadarko Basin.

Despite the obvious presence of hydrocarbons, nobody has promised these companies a rose garden. With as many as 10 vintage producing units in a single governmental section and with the base leases often dating back to the 1950s, land and title issues abound. Applications at the Oklahoma Corporation Commission have been protested and unresolved for months. With respondent lists numbering well over 500 parties, operators are bound to cross paths with those who would like to thwart progress and horizontal development.

It will be quite the melee for the four Tulsa operators as they scrap to put together horizontal units two acres at a time.

More to follow,

Berlin

Ready to Sell?

Request your No Cost, No Obligation Offer to Trade or Sell Your Oklahoma Mineral Rights and Oil and Gas Royalties by Clicking Here or Calling Berlin Royalties at 918.984.1645