See What Happens Larry? Oil and Gas Mineral Rights in the News.

Oklahoma Oil and Gas Mineral Owners,

The Federal Bureau of Investigation (“FBI”), announced that LAWRENCE H. WOLF, a/k/a “Larry,” was arrested yesterday for defrauding banks and financial institutions around the country. Manhattan U.S. Attorney Geoffrey S. Berman said: “As alleged, Lawrence Wolf swindled and attempted to swindle banks around the country out of millions of dollars while masquerading as an oil and gas tycoon. Now, thanks to the dedicated work of our partners at the FBI, Wolf’s alleged scheme has finally run dry.”

A tale as old as time. A slick huckster in cowboy boots will convince a number of yield-starved investors that he has a deal for them. We saw it in "Stealing from the Rich" and "Funny Money" and we will continue to see it as long as there are mineral rights to exploit and people walking the earth (so another 73 years...?).

Do you see what happens when you commit fraud by claiming ownership in others' mineral rights?

Berlin's favorite part of the story though is that four banks lent Larry money and only the "global investment firm" actually ran title to the oil and gas properties in Wyoming that Larry was claiming ownership in.

While Berlin has claimed in the past that some title is difficult, it is less difficult that explaining to your boss why you lent Larry millions without checking the records.

H/T to Matt Levine for the news and Special Agent Justin Rowland for putting the pieces together.

Bankers of the world, please advise Berlin if you are planning to lend on oil and gas mineral rights, royalties, or leases without running title and we can prevent you from being identified as a "Victim Firm."

More to follow,

Berlin

Share Buybacks: Weird News from Matt Levine

Oklahoma Oil and Gas Royalty Owners:

The always outstanding Matt Levine of Bloomberg, wrote great commentary on a recent Wall Street Journal piece about share buybacks in the oil and gas industry.

Matt quotes:

Laredo’s shares are trading more than 20% below what the company sold stock for in three offerings during the downturn.

snake_oil = "Public Equities" print (snake_oil)

Public Equities

Noble Energy Inc. and Gulfport Energy Corp. are likely to buy at even bigger discounts to what they sold shares for in recent years. Noble said last week it would use proceeds from the sale of its Gulf of Mexico fields to repurchase $750 million of its stock, which is trading about 45% below the $47.50 its shares fetched in a $1.15 billion offering three years ago. Gulfport said it plans to buy back $100 million of the stock it sold at prices ranging from $21.50 to $47.75 in four offerings between April 2015 and December 2016. The Oklahoma City company’s shares ended Friday at $8.75.

and writes:

Don't get used to this! It is traditional to make fun of companies for buying high and selling low when they trade their own stock, but it is surely better than the alternative. After all, there is someone on the other side of those trades, and it's the shareholders. If companies could regularly raise money by selling stock when business was bad, and then buy that stock back more cheaply when business recovered, then what would be the point of investing in stocks?

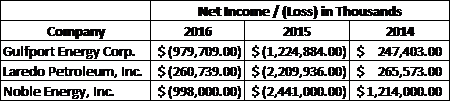

Berlin believes that most public oil/gas equities are a hustle to begin with. SEC reporting requirements and metrics mislead the public about the health of the company. Net income for the companies mentioned above are captured in the chart:

Who likes losing massive amounts of money?

Why do folks buy shares of a company (who Berlin presumes actually want a claim on future profits and cash flows of that company) that sells its assets for less than it takes to replace them? Why continually throw money at a money losing enterprise where management incentives are so clearly misaligned from yours? A mystery to Berlin. Management lacks the skin in the game to promote reasonable governance. Berlin forecasts these managers blaming "capital markets" and "a shift in the macro-headwinds" before a mea culpa.

More to follow,

Berlin

Ready to Sell?

Request your No Cost, No Obligation Offer to Trade or Sell Your Oklahoma Mineral Rights and Oil and Gas Royalties by Clicking Here or Calling Berlin Royalties at 918.984.1645