Same Same, but Different

All,

Bethany McLean argued in a recent New York Times piece that some exploration and production companies that drill and frac horizontal oil and gas wells are on shaky financial footing due to the fact that most don't make money….

All,

Bethany McLean argued in a recent New York Times piece that some exploration and production companies who drill and frac horizontal oil and gas wells are on shaky financial footing due to the fact that most don't make money. This is a good argument and it makes sense! She is correct to note that most of the drilling is driven by companies that are able to acquire cheap debt from yield starved Wall Street investors. Berlin agrees that an increased money supply has forced interest rates lower than they ought to be. This decreased cost of capital allows more projects to pencil as viable.

What Berlin takes issue with is the fear mongering title of the article "The Next Financial Crisis Lurks Underground." Now, Berlin isn't an expert in synthetic collateralized debt obligations (but will taken an organic, gluten/dairy free, and pastured CDO of course, thanks), but here are some takeaways from the causes of the last financial crisis:

Mmmm...pastured, organic financial products above Oklahoma oil and gas mineral rights.

- Banks lent money to subprime borrowers, but lied about the credit worthiness of the borrowers, and sold these mortgages downstream.

- Companies sliced and diced these mortgages into complex derivatives. Few people understood the quality of the underlying assets.

- These derivatives were given favorable ratings by the credit rating companies which qualified them to be purchased by firms thinking they were less risky than the actually were.

- Insurance companies wrote polices on these derivatives and mis-priced the risk. Some of these insurance products were also make into derivatives.

- Housing prices decreased and the pile of mis-priced risky assets collapsed.

I'm sure the usual commentators will point out that Berlin missed a couple key bullets, but those are the basics. What is similar in these situations (housing and oil) is that investors are looking for yield (but that is always the case) because debt is cheap. What is different in these situations is that the housing precipitated financial crises was fraudulent, opaque, and systemic. People lied about the quality of the assets, people turned these assets into financial products that few understood, and these products were sold to firms across multiple industries.

Berlin doesn't believe that the banks underwriting these oil companies' debt offerings are committing fraud. The oil companies are admitting in their financial reporting that they are losing money. Yet folks are buying these bonds anyways as the risk premium is apparently worth it. So while it is bad for the equity owner when the company loses money, it isn't necessarily bad for the management team (who always seems to be paid well), and for the holders of the debt if they are confident that the company can continue to roll their notes forward.

These bonds also do not appear to have been turned into derivatives and sold across multiple industries. For these reasons, Berlin believes that if in fact oil producers do go belly up (as they do from time to time), it will not cause an international financial crises like we saw in 2008.

Please leave your comments below.

More to follow,

Berlin

The Money Spring

Mike Shellman at Oily Stuff, pens the best blog on the oil business. He often writes regarding the unsustainability of the shale drilling business model. In his most recent post, he commented on a recent report that Haynes & Boone released on what sources companies are using to raise capital to fund their 2018 exploration and production efforts….

All,

Mike Shellman at Oily Stuff, pens the best blog on the oil business. He often writes regarding the unsustainability of the shale drilling business model. In his most recent post, he commented on a recent report that Haynes & Boone released on what sources companies are using to raise capital to fund their 2018 exploration and production efforts. The report indicates that 58% of the capital deployed in 2018 will be from the raising of debt. Berlin argues that this number is actually higher as the report notes that "Joint Ventures with Private Equity firms such as farmouts, drillcos, etc" will account for 12% of the capital deployed in 2018, but those arrangements are going to be partially funded with debt also. Regardless, there is a lot of borrowed money at play.

Sheikhs v Shale from The Economist

Is this sustainable? Mike argues that it is not and his fact based writing often explains why. Berlin argues that it is sustainable. There are many reasons why it is sustainable and listed below are a few of them:

- We have an expanding money supply that keeps interest rates artificially low and drives yield hungry investors to riskier margins....and

- Incentives are skewed in most public corporations and management teams often enrich themselves at the expense of the majority of the owners. This can be observed when companies take on new debt to improve short term metrics at the expense of the company's long term financial health and stability....and most importantly

- The longer something has occurred, the more likely it is to continue to occur. While 15 years is not a long time in the span of world history, capital markets have been funding marginally profitable shale wells for 15 years. You might say "it does not make sense, why are these companies being funded?" Berlin would argue that it is your mental model that does not make sense and needs to be updated. It hurts her head too, after all, wouldn't the equity stake holders want to profit on their investment? But, since the market has funded the exploration efforts, it makes sense.

Please comment below or contact Berlin with any more questions about the suitability of debt financing and the continued sustainability of the shale drilling business model. Or if you would like to sell your Oklahoma mineral rights under any unconventional (and conventional) oil and gas well.

More to follow,

Berlin

"Yes Please, I'd Rather Have a Dividend" - Stockholder

As yall are well aware, Berlin's finance (that's "fuhnance") prowess is on par with her triple lutz, triple toe, which is non-existent. That being said, Berlin does know that as an stockholder one has claim to the future profits of the firm...

Oklahoma Oil and Gas Interest Owners:

As yall are well aware, Berlin's finance (that's "fuhnance") prowess is on par with her triple lutz, triple toe, which is non-existent. That being said, Berlin does know that as a stockholder one has claim to the future profits of the firm. Profits can be retained by the firm or issued as dividends to the owners. If the owner of the firm thinks that the firm will be able to invest the profits more wisely than the investor can elsewhere else, he will be grateful if the company retains the profits and chooses another wise investment for his capital. On the other hand, if the investor has better uses for the company's (his) profits than the company, he will push for dividends.

Production wedges....

In a Retuers' piece, Ernest Scheyder reports that investors in oil and gas concerns are demanding dividends and also according to the chief executive of energy investment at Tudor, Pickering, Hold & Co. “investors are looking for improving results, better returns and operational performance” (Maynard, wouldn't it be weird if they weren't?).

On one hand, at least these companies are now making a profit. On the other, it is not necessarily a vote of confidence for the stockholders to be demanding their cash. Since producing oil and gas requires that the company deplete its oil and gas reserves (read, assets), companies must always be acquiring new leases. Acquisitions and the development of these acquisitions require cash. Because it has proven difficult for companies to grow their production wedge out of free cash flows and with the owners taking their cash elsewhere, this will lead companies to the debt markets which Berlin has mentioned before is problematic.

If you think Berlin has erred in her analysis or you would like to sell your Oklahoma oil and gas mineral rights and royalties. Please drop us a line or comment below.

More to follow,

Berlin

PS: Thanks to DC for his winning submission to Berlin's query regarding the meaning of "MERGE". "Must Everything Require Grand Epithet" = $10 Amazon gift card.

Share Buybacks: Weird News from Matt Levine

Oklahoma Oil and Gas Royalty Owners:

The always outstanding Matt Levine of Bloomberg, wrote great commentary on a recent Wall Street Journal piece about share buybacks in the oil and gas industry.

Matt quotes:

Laredo’s shares are trading more than 20% below what the company sold stock for in three offerings during the downturn.

snake_oil = "Public Equities" print (snake_oil)

Public Equities

Noble Energy Inc. and Gulfport Energy Corp. are likely to buy at even bigger discounts to what they sold shares for in recent years. Noble said last week it would use proceeds from the sale of its Gulf of Mexico fields to repurchase $750 million of its stock, which is trading about 45% below the $47.50 its shares fetched in a $1.15 billion offering three years ago. Gulfport said it plans to buy back $100 million of the stock it sold at prices ranging from $21.50 to $47.75 in four offerings between April 2015 and December 2016. The Oklahoma City company’s shares ended Friday at $8.75.

and writes:

Don't get used to this! It is traditional to make fun of companies for buying high and selling low when they trade their own stock, but it is surely better than the alternative. After all, there is someone on the other side of those trades, and it's the shareholders. If companies could regularly raise money by selling stock when business was bad, and then buy that stock back more cheaply when business recovered, then what would be the point of investing in stocks?

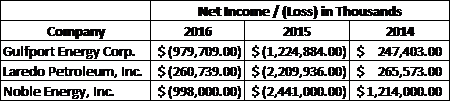

Berlin believes that most public oil/gas equities are a hustle to begin with. SEC reporting requirements and metrics mislead the public about the health of the company. Net income for the companies mentioned above are captured in the chart:

Who likes losing massive amounts of money?

Why do folks buy shares of a company (who Berlin presumes actually want a claim on future profits and cash flows of that company) that sells its assets for less than it takes to replace them? Why continually throw money at a money losing enterprise where management incentives are so clearly misaligned from yours? A mystery to Berlin. Management lacks the skin in the game to promote reasonable governance. Berlin forecasts these managers blaming "capital markets" and "a shift in the macro-headwinds" before a mea culpa.

More to follow,

Berlin

Ready to Sell?

Request your No Cost, No Obligation Offer to Trade or Sell Your Oklahoma Mineral Rights and Oil and Gas Royalties by Clicking Here or Calling Berlin Royalties at 918.984.1645